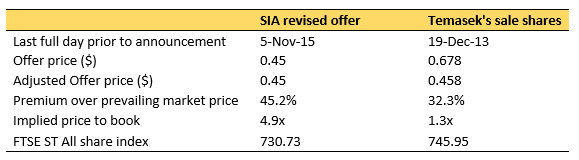

We see the latest move by SIA as positive for SIA and minority shareholders of Tigerair who have either accepted or plan to accept the revised offer. Specifically for SIA, declaring the offer unconditional offers it a couple of advantages.

Higher chance of SIA getting to the compulsory acquisition threshold

Firstly, it means that SIA can now extend the offer beyond the 60th day (25 January 2016) to 5 February 2016. As explained in our previous post, an offer will not be allowed to extend beyond the 60th day after the date of posting of the Offer Document unless it has become or been declared unconditional. This is important for SIA as its ultimate aim is to be able to fully privatize Tigerair. Being able to extend the offer period gives it more time to accumulate acceptances and consequently a higher likelihood of bringing its total shareholdings across the compulsory acquisition threshold of 95.58%.

Opens up other privatization options in future

Furthermore, declaring the offer unconditional allows SIA to keep any shares tendered during the offer period even if its resultant shareholding ends up being less than 90%. From a strategic perspective, the tighter control opens up future privatization options such as a voluntary delisting via Rule 1307 of the SGX Listing Manual where, as the majority shareholder holding more than 75%, it will be able to vote through the delisting resolution subject to no more than 10% of shareholding votes present at the general meeting voting against it.

News is positive for shareholders who intend to accept…

For shareholders who have already accepted or intend to accept the revised offer, the waiver of the 90% acceptance condition gives them certainty of monetizing their holdings at the offer price. This is unlike under the previous scenario, where they would have to wait for SIA’s total shareholdings plus acceptance level to cross 90%.

…but not so much for dissenting shareholders.

On the other hand, shareholders who had intended to hold out with the expectation that SIA may revise the offer price upwards again, however low the possibility, will be solely disappointed to see their hopes dashed. For this group of shareholders, you may refer to Scenarios B and C depicted in our previous post.

RSS Feed

RSS Feed